Managing payment and return orders

Check statement

Statement, reconciliation, and payment activities are crucial parts in the chain of operations when doing e-commerce business. Sellers will benefit from careful and effective management in order to have better control over financial resources and conduct business more efficiently.

Tiki will publish statements on a regular basis to assist sellers in following up on the payment status of orders, hence serving the function of periodic reconciliation.

Statement frequency: 02 (two) times/month: on the 1st and 16th of every month.

|

Statement schedule |

Statement release date |

|

From 1st to 15th of every month |

On the 16th |

|

From 16th to the last day of every month |

On the 1st of the following month |

There are 3 steps in the process of checking statements and transactions:

Check statement balance > Track recorded transactions > Transaction reconciliation

Step 1. Check statement balance

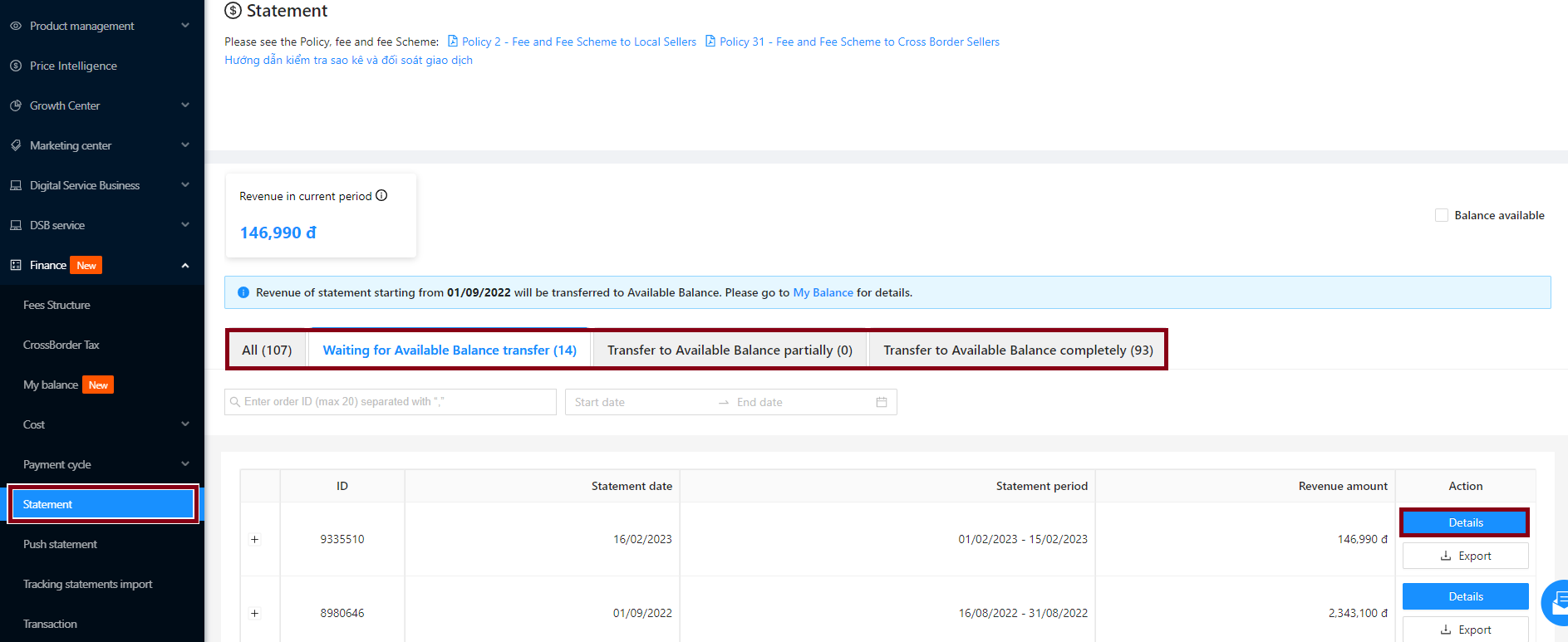

The Seller goes to Finance > Statement > Select a statement period and choose Details to check the Statement balance or export report to check according to the statement period.

+ You can search by order ID (20 codes/time) or statement period with different statuses will be displayed in All tab.

-

All orders on the statement that have not yet been eligible for the available balance to claim payment will show up as Waiting for Available Balance transfer.

-

Some of the orders on the Seller’s statement that have entered the available balance will show up as Transfer to Available Balance partially.

-

All orders on the Seller’s statement that have entered the available balance will show as Transfer to Available (Seller hovers over the status name to see the meaning)

Step 2. Track recorded transactions

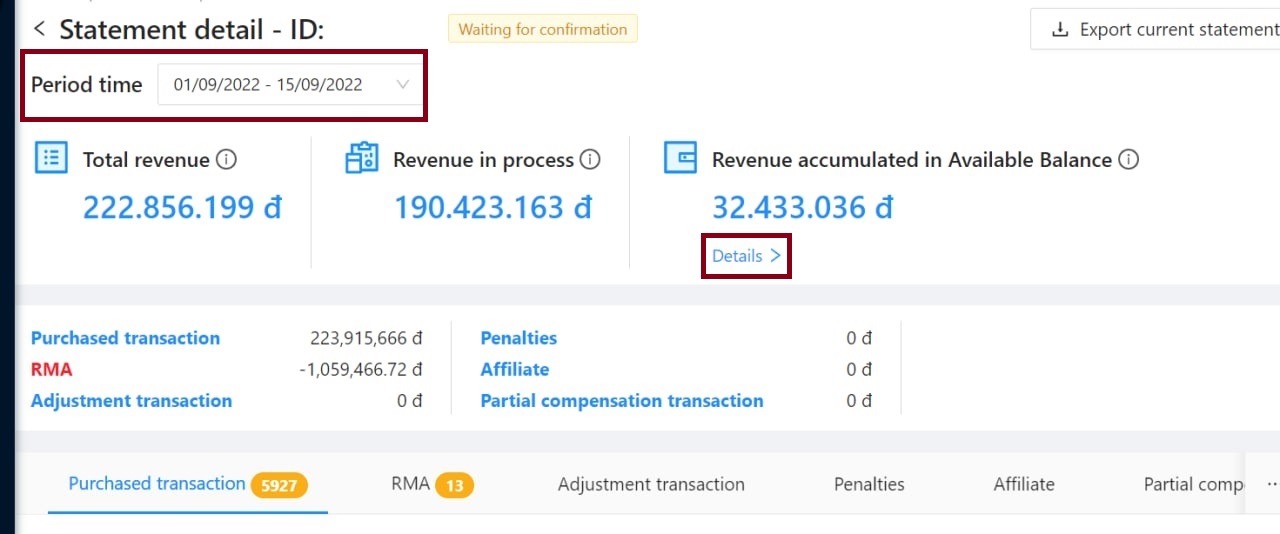

Here, the Seller can track information such as:

-

Total revenue: The seller’s total sales in the current statement period.

-

Sales in process: The total sales that are being processed for being recorded to the seller’s available balance.

-

Revenue accumulated in Available Balance: Total sales recorded in the seller’s available balance.

Step 2.1: At the Statement detail page, the seller can view the transaction details. The wallet icon represents the revenue that has been transferred to the Available Balance

The list of transactions recorded in the statement includes:

-

Purchased transaction

-

RMA (Product exchange/return transaction)

-

Adjustment transaction

-

Penalties

-

Affiliate

-

Partial compensation transaction

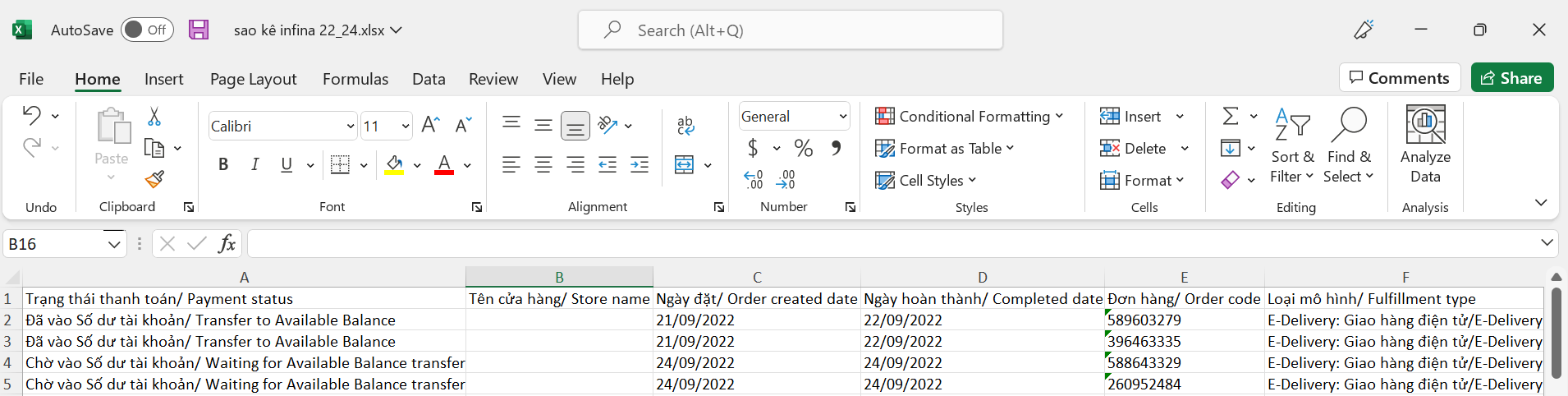

Or you can click on Export current statement to view detailed information under an Excel file.

Step 3. Transaction reconciliation

Step 3.1: Check the Fees that Tiki applies when processing orders, including: Discount fee, Payment fee… You can calculate the Rate (%) Fee to pay Tiki / Cost of goods sold with successful Delivery status has been recorded. (Same for RMA transactions, Adjustment transactions).

Step 3.2: In case the system miscalculates the fees compared to the provisions in the contract or the number of orders on the statement is inappropriate, please send the order code within 30 days from the date of issuing the statement to the our Partner Support Center (PSC) via email support@tiki.vn/hotrodoitac@tiki.vn for support.

Step 3.3: Tiki receives your information, checks the transaction and makes an additional adjustment transaction in the next statement period (if any).

1. Types of e-invoice

Tiki issues to Seller 2 types of invoices as follows:

|

Invoice no. |

Type of invoice |

Including |

Note |

|

1 |

New Invoice |

|

There will be 1 e-invoice per each period |

|

2 |

Adjustment Invoice |

|

Each adjustment invoice will make a specific adjustment to a previous original invoice. (There may be more than one adjustment invoice in the period) |

Notes:

-

The purchase party information on the invoice will be exported according to the information the seller provided in the registering process. If this information changes, then you will need to contact Tiki for support to update the information, to avoid the case that the invoice is issued with outdated or incorrect information.

-

The invoice date is the date Tiki issues the invoice. For example: Invoice of the statement period from September 1, 2022 – September 15, 2022 – Payment date September 16, 2022 > Invoice date is within the next 05 working days from the date of payment (From September 16, 2022 to September 23, 2022).

-

Invoicing period: Tiki issues invoices 2 times/month.

-

1st time: Issue service invoices for orders recorded in the statement

-

2nd time: Issue service invoices for the orders recorded in the statement

-

-

Total amount due: Total charge = Total fees to be paid to Tiki during the statement period. Including the total charge owed to Tiki as a result of sales transactions. Tiki will charge an exchange/return/warranty fee (RMA), Tiki adjustment transaction fee, Platform management service – multi-payment activity cost.

2. Check for e-invoice

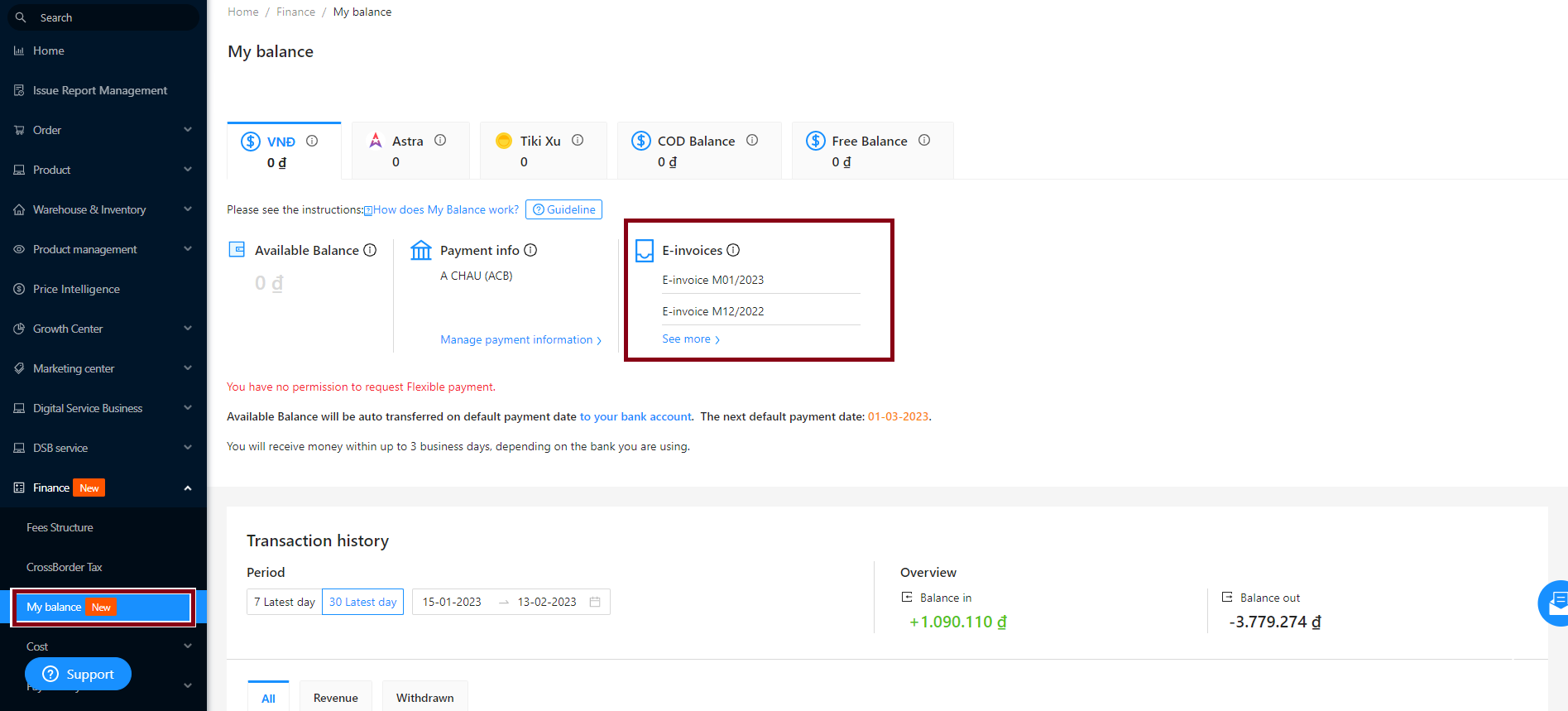

Method 1: Check your e-invoice on Seller Center

At the Seller Center, choose Settlement > My balance. In the section E-invoices, Tiki service fee invoices will be displayed for collected fees. Seller clicks See more to filter by a time period and view a list of invoices for the current year.

-

Tiki will send invoices to sellers 2 times/month.

-

Service Invoice Deadline: Within 05 working days after the last day of the invoice period.

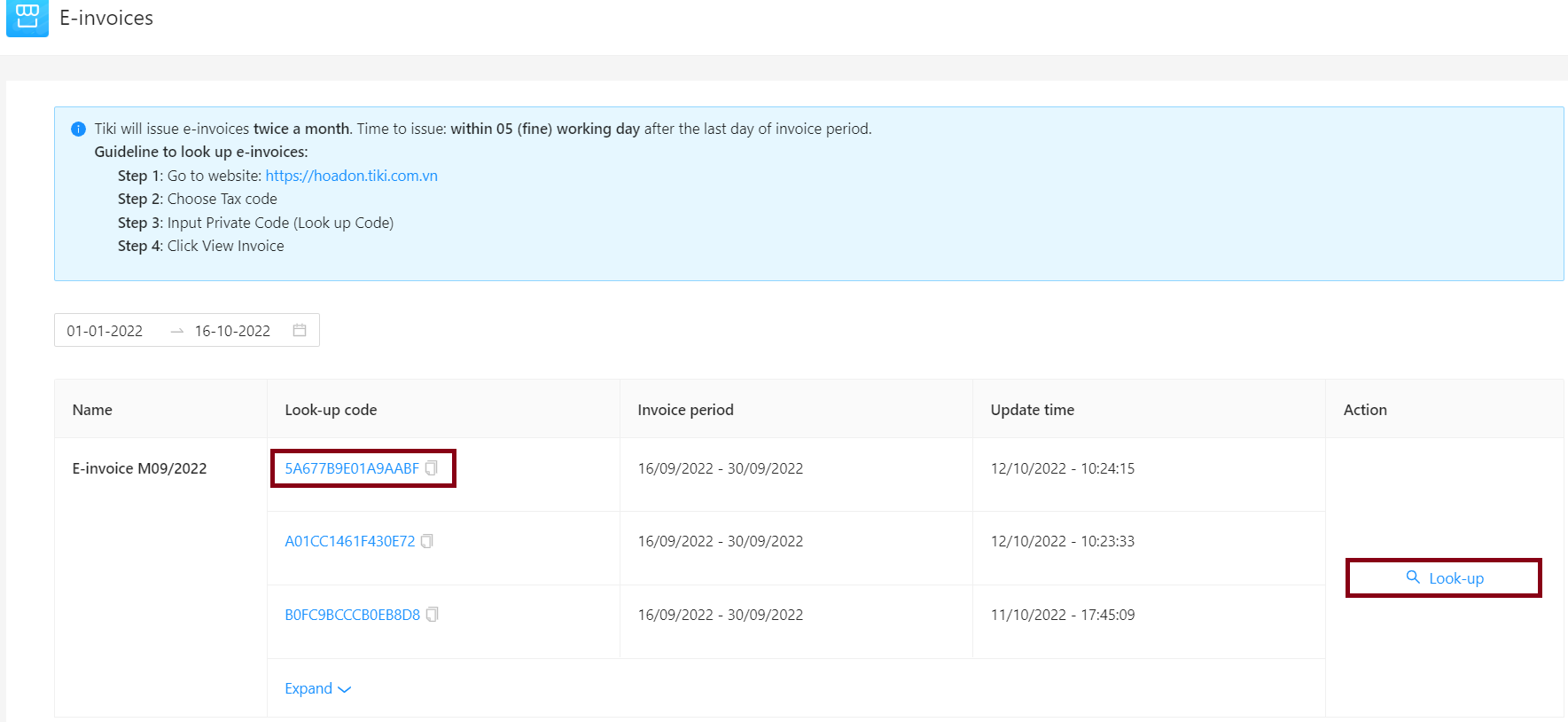

To check for e-invoices, please follow these steps:

Step 1: Please copy the Look up code. In the Actions column, click Look-up.

Step 2: The system redirects to https://hoadon.tiki.com.vn. You need to enter the selling party tax code of Tiki (Mã số thuế bên bán): 0309532909 (Please use translation tool to support you).

Step 3: Enter the security number (Mã tra cứu hóa đơn) and click View invoice (Xem hóa đơn).

Method 2: Check your e-invoice through your email

In addition to the e-invoice details on the Seller Center, the invoice will be sent to the email of the Store creator.

In order to ensure that the email information of Tiki invoices is received, please update your email information correctly and accurately. If there is a change in the email received, please update your new Seller info via Seller Center.