Managing payment and return orders

Import tax function

1. Definition

Import tax is a tax applied for every global product imported and consumed inside Vietnam territory. All orders above 1,000,000 VND are high value orders and have to submit Import tax for Vietnam Customs.

Please refer to this file to see the specific tax rate for different categories: link.

2. Calculation formula and examples

The goal of this section is to provide more clarity so that sellers can come up with a beneficial and effective price for specific products.

The tax will be calculated as below:

-

Import Tax = Selling Price * Quantity * Import Tax Rate

-

VAT Tax = (Selling Price * Quantity + Import Tax) * VAT Tax Rate

-

Total Tax = Import Tax + VAT Tax

Please see these examples for better understanding:

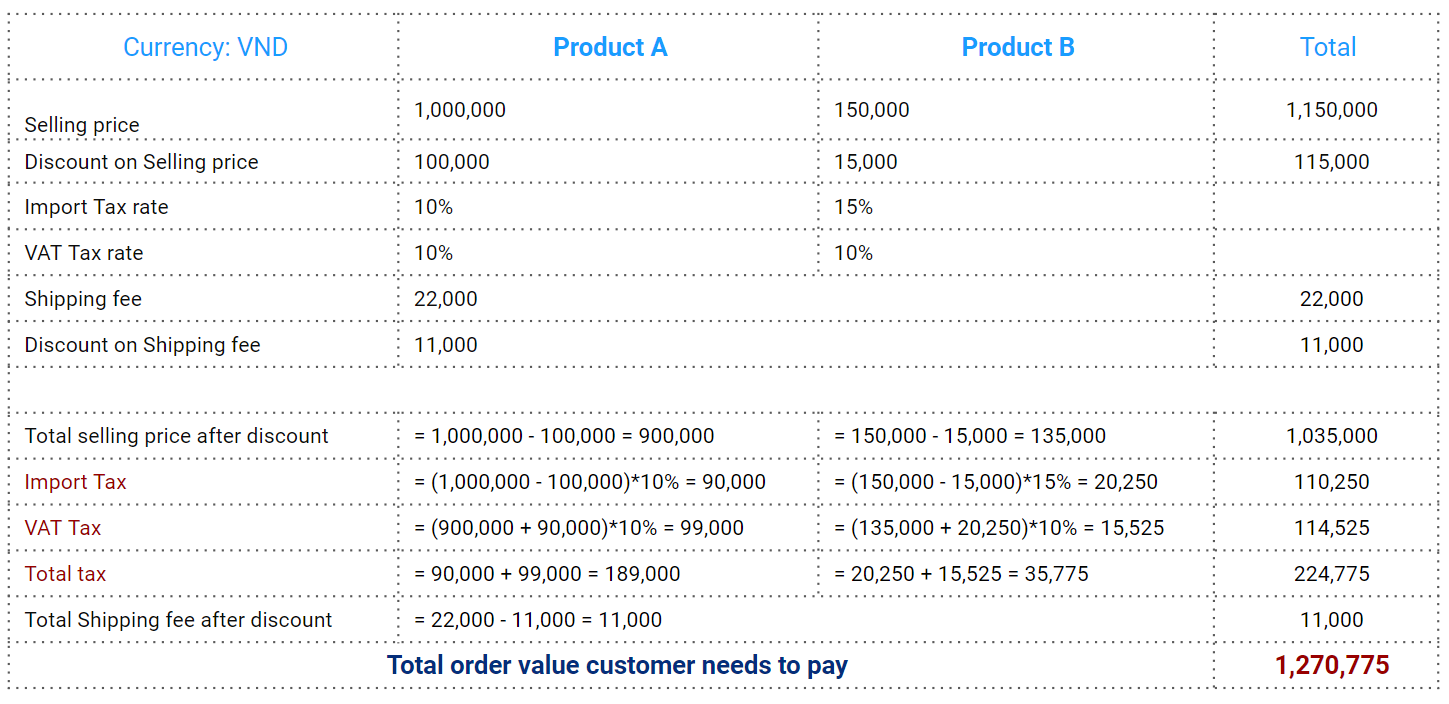

Given that the order includes 2 items (product A and product B) and other data is as follows:

-

Selling price: Product A : 1,000,000 VND, product B: 150,000 VND.

-

Discount on selling price: Product A: 100,000 VND, Product B: 15,000 VND.

-

Total price after discount: 1,035,000 VND > 1,000,000 VND so customer needs to pay for import tax.

-

Import tax rate: Product A: 10%, product B: 15%.

-

VAT tax rate: 10%.

-

Shipping fee: 22,000 VND.

-

Discount on shipping fee: 11,000 VND.

Tiki will calculate the import tax as shown in the below table:

-

For low level order: for orders with a total value less than 1,000,000 VND, Tiki accepts 100% refund for customers for any reason.

-

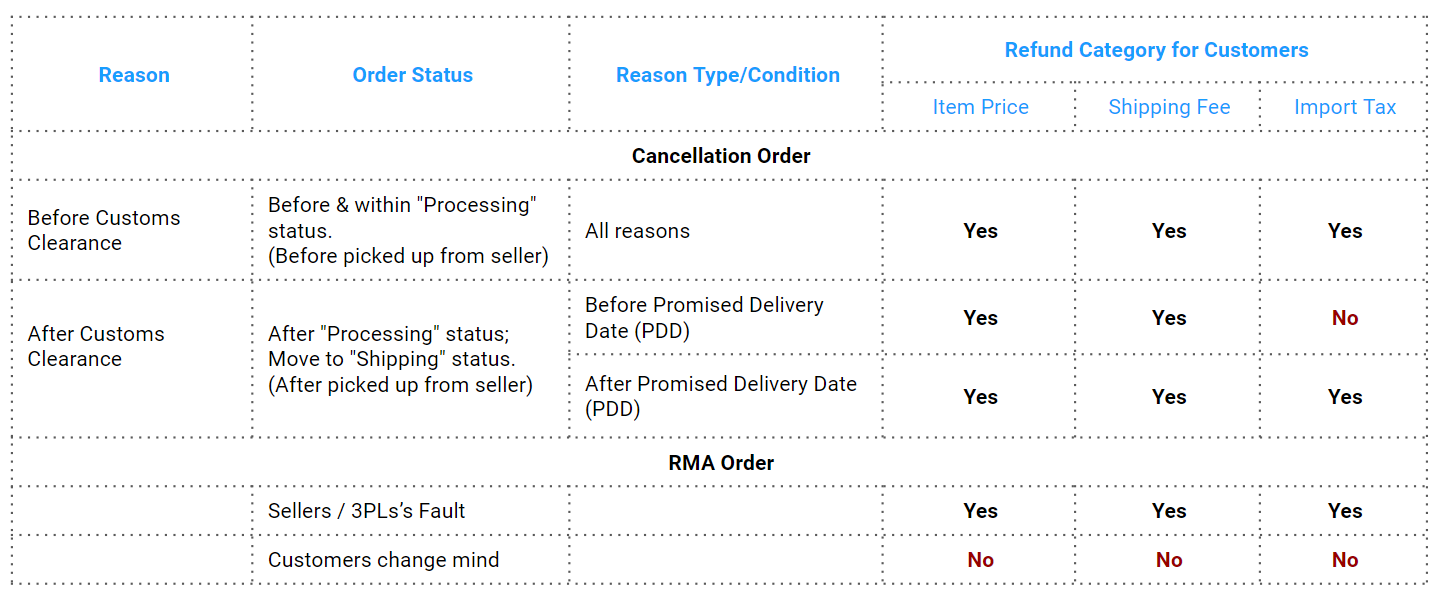

For high value order: Tiki still supports canceling orders with a total value equal to or higher than 1,000,000 VND, and the import tax amount will be listed in the table below for each specific case.